Cost Controller

Reports to: CFO

FLSA Status: Salary Exempt

SUMMARY:

The Cost Controller plays a critical role in managing, monitoring, and optimizing the company's financial performance, particularly regarding cost control and efficiency. This role ensures the integrity of financial reporting, compliance with regulations, and alignment with company objectives. The Cost Controller will work closely with the CFO and Manager of Accounting to drive financial strategy and operational excellence.

Key Responsibilities:

- Manage cost accounting, inventory, and miscellaneous financial reporting.

- Support compliance with GAAP and company policies and facilitate IFRS reconciliation with parent company.

- Develop and implement financial policies, procedures, and internal controls to safeguard company assets.

- Prepare and present accurate and timely financial reports to the CFO and executive team.

- Conduct financial planning and analysis to support strategic business decisions, including scenario planning, financial budgets and forecasts.

- Manage Capital Expenditure projects to ensure alignment with budgets and expected ROI. Analyze cost-benefit scenarios for proposed investments.

- Support the month-end and year-end close processes, ensuring accuracy and completeness.

- Participate in the audit process in appropriate areas (Cost, Inventory, etc.).

- Work closely with operations to monitor and manage inventory levels, ensuring accurate financial reporting for inventory and controlling any excess or obsolete stock.

- Manage cost accounting processes to track production costs, materials, labor, and overhead, ensuring accurate product costing and profitability analysis. Analyze cost structures and margins to help management control manufacturing expenses and improve profitability.

- Analyze financial data to identify trends, risks, and opportunities for operational improvement across departments.

- Drive ERP system enhancements and ensure robust integration with financial processes.

- Complete other duties as assigned.

WORK ENVIRONMENT:

This job operates in a professional office setting. This role routinely uses standard office equipment such as computers, phones, photocopiers, filing cabinets and fax machines.

Physical Demands:

The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job.

While performing the duties of this job, the employee is frequently required to sit at a desk. Standing and walking to different departments will be required. The employee will need vision to see close, peripheral vision, depth perception and the ability to adjust focus, talk, hear and listen.

Position Type and Expected Hours of Work:

This is a full-time position, working Monday through Friday, 7:30 am to 4:00 pm. Overtime when needed and weekend work per customer requests and needs.

Qualifications:

- Bachelor’s Degree in Accounting, Finance, or related field (CPA or CMA preferred).

- 8-10 years of progressive industrial cost controlling and accounting experience, preferably in a manufacturing environment.

- Strong leadership skills with experience managing cross functional projects.

- Extensive knowledge of GAAP, financial reporting, and internal controls.

- Proficiency in ERP systems and Microsoft Office Suite, particularly Excel.

- Excellent communication and interpersonal skills.

- Ability to handle complex financial issues and provide strategic guidance.

- Strong problem-solving abilities and attention to detail.

Preferred Qualifications:

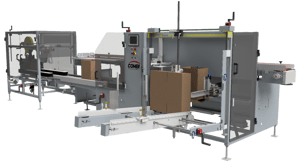

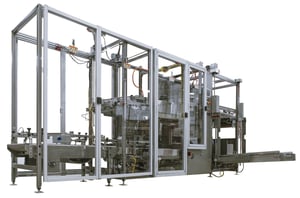

- Experience in the packaging or industrial equipment industry.

- Expertise in cost accounting and inventory management.

- Experience in Financial Planning and Analysis.

- Advanced financial modeling and data analysis skills.

- Knowledge of IFRS accounting.

- CPA